|

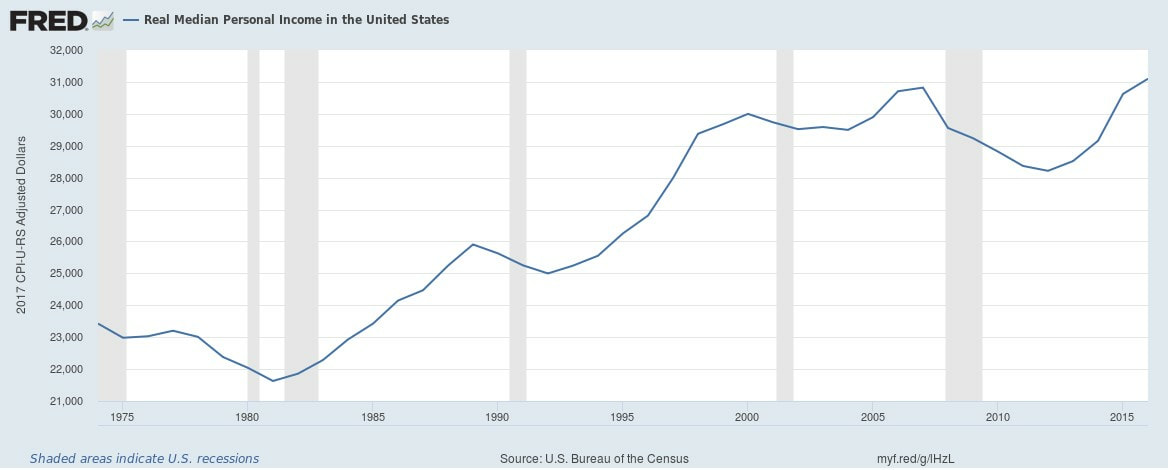

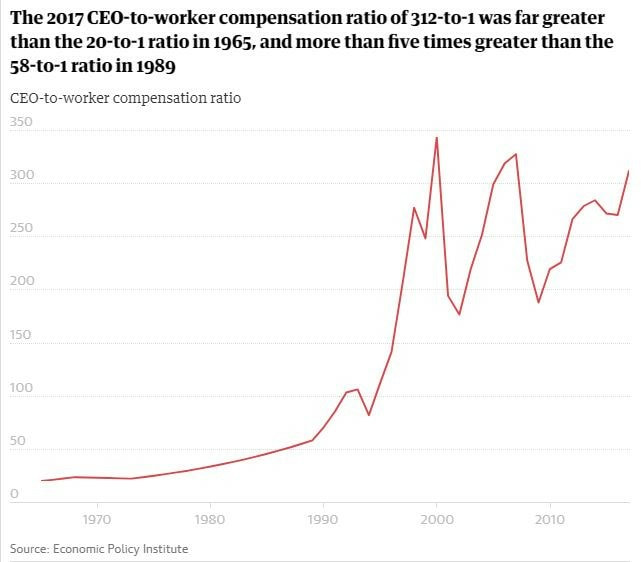

The drumbeat that corporate stock-buybacks are counter-productive is rising. The Senator Schumer and Senator Sander’s NYT op-ed limiting corporate stock buybacks (LINK), and growing support from both sides, has politicized the discussion. A purpose of this blog is to explore investment implications of important issues, but to stay outside the political fray. A stock buyback is a simple, and efficient capital allocation tool, but let’s examine what a buyback really is in layman terms and then you can decide if it is good or evil for society? I love ice cream, so grab your favorite flavor and dive in. Let’s assume you are a part-owner of ‘World’s Best Ice Cream’. Ice cream is a good year-round business where you live. The town is slowly growing, service is top-notch, and the business has great reputation. Therefore, competition is limited. Every year, the business grows by 2-3%. The store is profitable and generates copious amount of cash flow. But no one would dare characterize the business as one of ‘rapid growth’. Therefore, hiring more employees, or expanding the building, will lead to a poor return on the incremental investment. Therefore, you have instructed the manager to return the extra cash-flow back to the owners. You are an entrepreneur and you would rather invest in other ventures with the best prospects. To reduce the risk of the initial investment, you took on several partners when you started the business. Every now and then, a partner decides to exit the business and the remaining owners are happy to accommodate and ‘buyback’ the seller’s stake. In this case, the manager is instructed to use the cash in the business to buy-out the exiting partner. The value of the business fluctuates but you plan on being in the ice cream business for decades. You are happy to buy out other partners at the fair prevailing price, because it gives you a larger share of the business and therefore a larger share of cash flow. Your ice cream business represents Corporate America, and public companies return extra cash flow in these two ways: 1) buybacks, and 2) dividends. Business is growing slowly but surely, but not at a pace where it requires incremental capital. If returning excess cash to owners is a sound practice for every private business owner, why would it be wrong or immoral if a similar practice is executed by publicly-traded companies? Shouldn’t we let the owners of these Companies – the shareholders and managers - decide where they should deploy excess capital? Post the financial crisis, we live in a world with deteriorating demographics and anemic growth. Don’t confuse the stock market for the economy. Rising corporate buybacks are a symptom of low-growth and lack of re-investment opportunities. As in any system, there are good and bad actors, but bad actors are generally an exception, not the rule. Companies that use buybacks for the wrong short-term reasons get punished by markets over the long run. Rules and regulations that are not based on first-principles have other bad consequences. For one, it will force companies to under-write bad investments. It is hard ‘to do nothing’ when you have a mountain of cash sitting next to you. Would you want your manager to expand the ice cream business just because cash is accumulating on the books? Would you want your manager to hire more employees without extra work? Answer is a clear ‘No’. Not only is throwing good money after bad ideas a poor solution, but it could also create other problems. Critical social issues of stagnant income (Real Median Personal Income) and rising income disparity (CEO-to-worker compensation ratio) need real attention and must be addressed with structural solutions, but limiting buybacks isn’t one of them ---

This material does not constitute an offer or solicitation to purchase an interest in Latticework Partners, LP (the "Fund"). Such an offer will only be made by means of a confidential offering memorandum and only in those jurisdictions where permitted by law. An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. This material contains certain forward-looking statements and projections regarding the future performance and asset allocation of the Fund. These projections are included for illustrative purposes only, are inherently speculative as they relate to future events, and may not be realized as described. These forward-looking statements will not be updated in future.

2 Comments

5/15/2024 03:15:06 am

Twilight Sparkle is the personal student of Princess Celestia in the animated television series "My Little Pony: Friendship Is Magic."

Reply

Leave a Reply. |

Amol DesaiI am an investor and these are my personal thoughts on investing, behavioral finance, markets, and sports viewed through the prism of a Latticework |

Proudly powered by Weebly