|

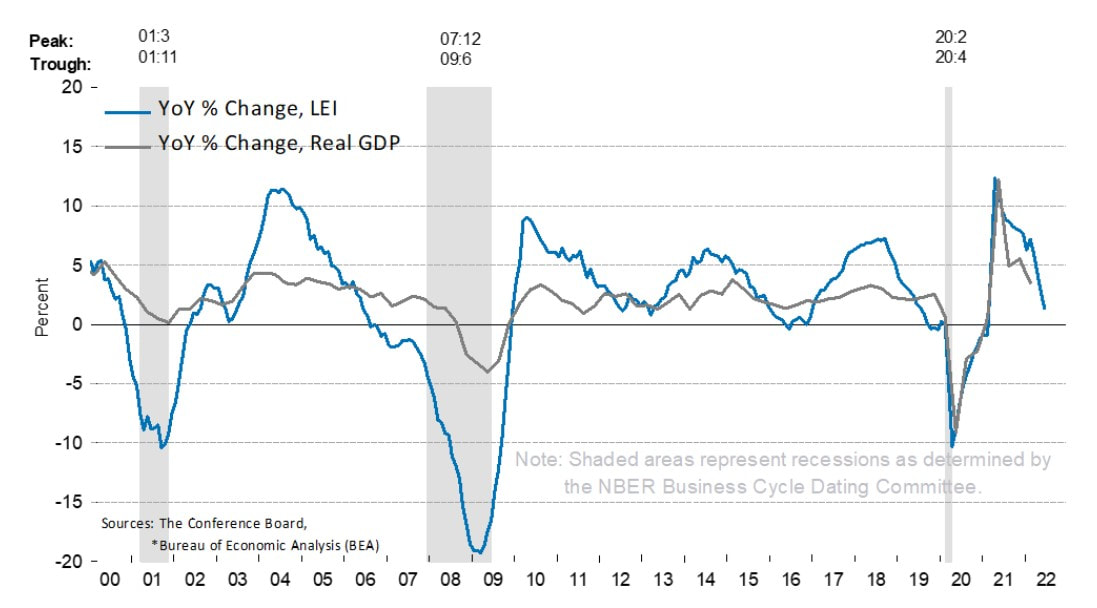

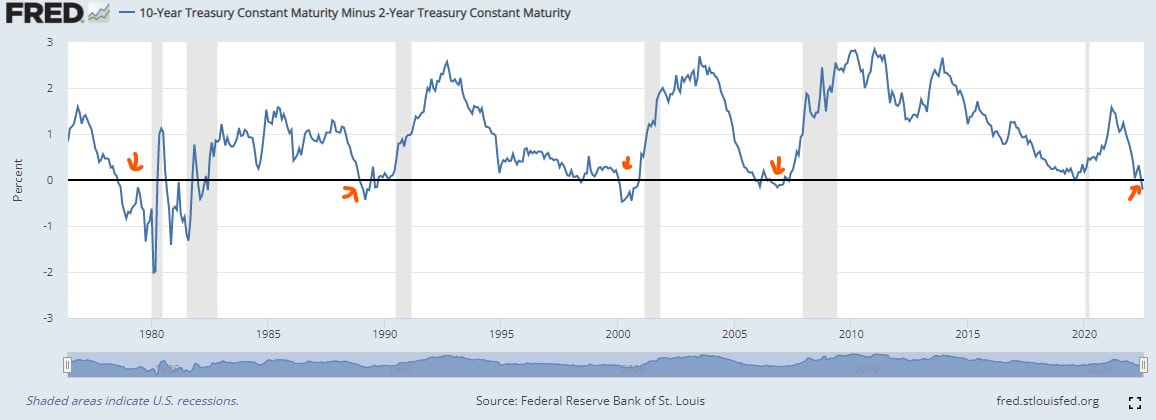

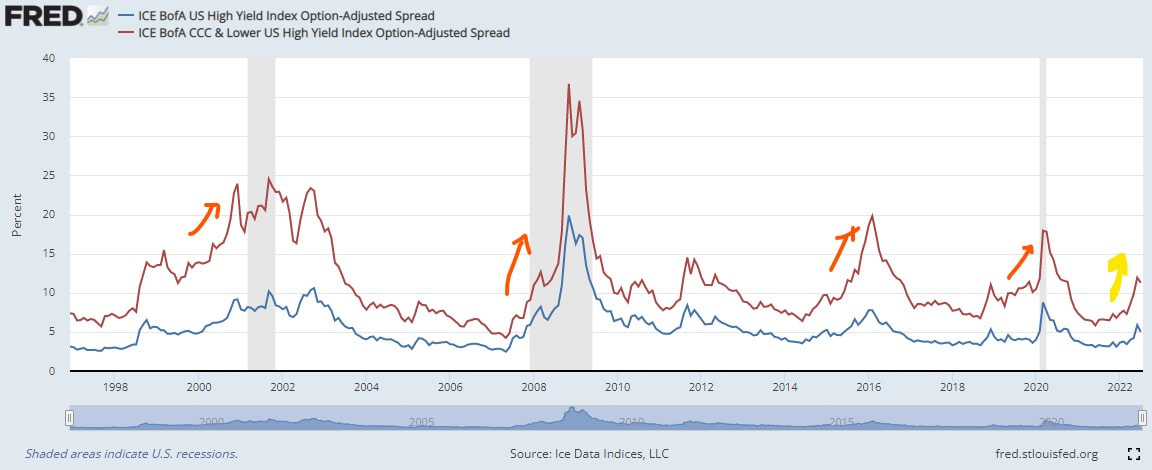

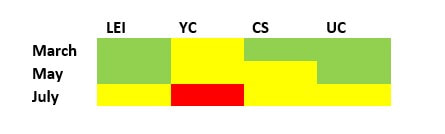

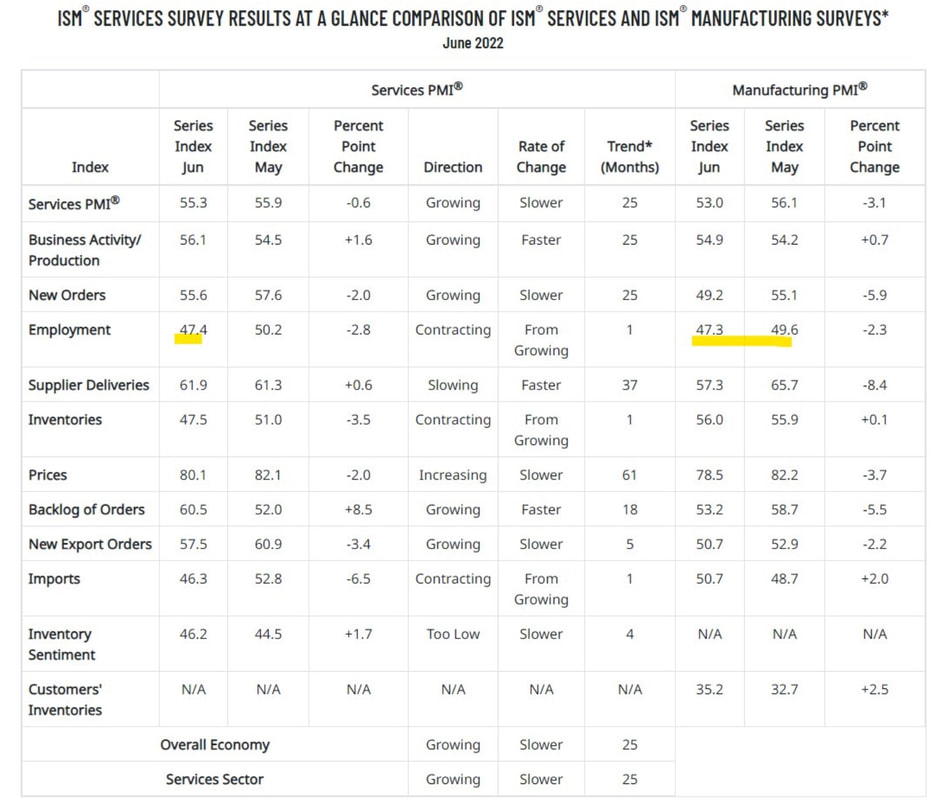

For context, here is the original Recession Framework essay LINK . Here is my recession framework that has proven the test of time. It has identified every recession Post World War II. There are four key criteria. Think of this as a dashboard with green, yellow, or red lights. If the dashboard is mostly green - sprinkled with a few yellows - we are safe. As the count of yellow and red lights rises, so does the risk of a recession. Similarly - reds turning to yellows is a sign of optimism -that the worst may be behind us. Remember, this is a dimmer, not an on/off switch. 1) Is the Leading Economic Indicator (LEI) gauge falling sharply and close to Zero? YES The LEI is a comprehensive forward looking metric that accounts for manufacturing new orders, building permits, change in hours worked, credit issuance, interest rates, stocks prices etc. As you can see above, when the LEI falls sharply and turns negative, a recession follows. Today, the LEI is falling sharply again, and close to turning negative. Manufacturing new orders and hours worked[1] in the ISM surveys are already contracting. Today, this is a yellow, but turns to a red once it falls below zero. 2) Has the yield curve inverted? Yes When long term rates are below short-term rates, lending is unprofitable. So, banks stop lending. New businesses cannot get off the ground and existing businesses cannot expand. This slows new economic activity. The 10 year rate is now firmly below the 2 year rate for several weeks, or inverted, in investment terminology. This is flashing red. As you can see in the chart above, a recession follows within 6 – 12 months of yield curve inversion. 3) Are credit spreads widening significantly? Almost When junk bond yields move significantly compared to (safe) treasury yields, it is a major warning. Investors are selling risky investments and buying safe ones. They are demanding a significant premium to compensate for the rising risk. Indicated by the red arrows above, at least a deep market sell-off, if not a recession follows. Today, credit spreads are moving higher, warning of potential trouble ahead, but not at recession levels. Today, this is a yellow, but close to turning red. 4) Are unemployment claims rising sharply? Almost When a business lays off an employee, that layoff is reported to the government and is captured as an unemployment claim. To avoid false signals, we need claims to rise sharply. This triggers a warning sign for the labor market. 70% of U.S. GDP depends on consumer spending, and consumers don’t spend when they are fearful of layoffs. As the red arrows (long term chart above) indicate, recession follow sharp and sustained spikes in claims. Over the past four months, claims have risen more than 25% (see below). A further rise would make a recession official. The recession dashboard has 1 red and three yellow lights. The deterioration since March speaks for itself. The yellows and red indicate we are on the cusp of a recession. (1) Employment in the manufacturing survey has contracted for May and June and June only for services (number below 50 indicates contraction) --

This material does not constitute an offer or solicitation to purchase an interest in Latticework Partners, LP (the "Fund"). Such an offer will only be made by means of a confidential offering memorandum and only in those jurisdictions where permitted by law. An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. This material contains certain forward-looking statements and projections regarding the future performance and asset allocation of the Fund. These projections are included for illustrative purposes only, are inherently speculative as they relate to future events, and may not be realized as described. These forward-looking statements will not be updated in future.

1 Comment

8/27/2022 11:11:53 am

anks for sharing the article, and more importantly, your personal experience mindfully using our emotions as data about our inner state and knowing when it’s better to de-escalate by taking a time out are great tools. Appreciate you reading and sharing your story since I can certainly relate and I think others can to

Reply

Leave a Reply. |

Amol DesaiI am an investor and these are my personal thoughts on investing, behavioral finance, markets, and sports viewed through the prism of a Latticework |

Proudly powered by Weebly