|

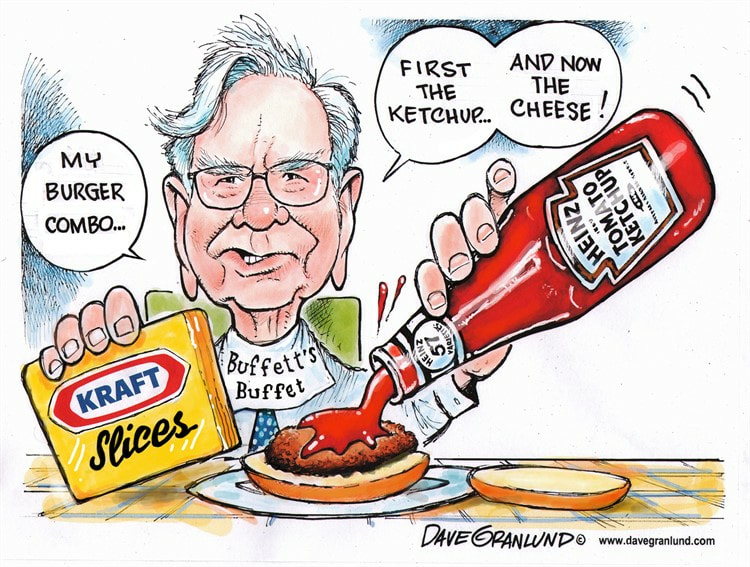

Could last Friday could be a seminal moment in the history of ‘Consumer Staples’ investing? A Company that was built on sliced cheese and ketchup did not announce a dividend raise. No, to the contrary, it declared a dividend cut. Now this is not just a run-of-the-mill consumer packaged goods (CPG) company. This is Kraft Heinz! Warren Buffet – who built the greatest investment track record by investing in ‘industries that move at the pace of a sloth’– better know as Consumer Staples - is the largest investor. 3G is the second largest investor. 3G is lesser known to non-investors, but the Brazilian Company is a Latin-American equivalent to the American Berkshire Hathaway. This post examines the reasons behind why a deep structural shift in CPG is upon us.

You may remember what I wrote approximately a year ago. Here is a link to the original post: consumer staples mean reversion is here. The rules of the game are changing. The dual moats of consumer staple companies are under attack from secular forces which they weren’t designed to defend against. Can dividend growth continue in the future at the same rate as in the past? It is highly unlikely. We are in the early stages of Staples under-performance. Mean reversion is at the doorstep of the consumer staples kingdom at last…. Below is a snippet what CEO of Kraft Heinz, Bernardo Hees had to say on his conference call with investors: Our industry has been and is likely to remain challenged on several fronts, continued fragmentation of consumer demand, a general lack of affordability to reinvest in brands, retail competition where assortment is likely to grow in importance and, finally, in the short term, ongoing cost inflation. To understand why demand is fragmented and competition is higher, we must understand how CPG companies acquired their structural advantage. This is an excerpt from the same blog: Over decades, CPG companies have grown by leveraging two wide moats: 1) a distribution moat, and 2) a scale moat. Let me explain. Before the days of online shopping, the retail aisle was the only place to purchase products. A business that produced better products, convinced retailers that their products would sell, or had a large consumer following; usually was awarded shelf space. Product marketing was important, but access to shelf space; a distribution moat; was truly the underappreciated competitive advantage. As retailers grew from tens to thousands of stores, shelf space grew exponentially. Helped by these secular trends, CPG businesses who possessed this distribution moat had an unassailable competitive advantage. We are intimately familiar with P&G, Nestle, Unilever today. CPG companies also leveraged this distribution moat into a scale moat. A growing business brought economies of scale. These companies purchased raw goods cheaper, built larger, efficient facilities, and spent less on transportation on a per unit basis. This larger footprint also brought scale advantages in advertising and marketing. When television was truly the most important medium, and therefore cost prohibitive for upstarts and smaller competitors, incumbents were able to leverage their large advertising budgets and low marginal costs to transform products into durable brands. A simple battery brought images of an energizer bunny, or a simple razor became the best a man could get, etc. The lack of demand in the ‘center aisle in grocery stores’ due to undifferentiated products is symptomatic to this issue. But why is now the time that our ‘tastes and preferences’ are changing faster than the ability for CPG to adapt to change? Hasn’t CPG been in the business of adapting to ‘changing tastes’ for decades? Here is a quote from “Competition Demystified: A Radically Simplified Approach to Business Strategy” by Bruce Greenwald: "We agree with Porter’s view that five forces—Substitutes, Suppliers, Potential Entrants, Buyers, and Competitors within the Industry—can affect the competitive environment. But, unlike Porter and many of his followers, we do not think that those forces are of equal importance. One of them is clearly much more important than the others. It is so dominant that leaders seeking to develop and pursue winning strategies should begin by ignoring the others and focus only on it. That force is barriers to entry—the force that underlies Porter’s “Potential Entrants.” Most investors understand that commodity products don’t stand a chance in a crowded arena, but don’t understand that even differentiated products have a hard time generating above-average profits if the barriers to entry are low. The barriers to entry for CPG have been lowered because: Marketplace platforms (Amazon, eBay, Walmart, Etsy etc.) act as business incubators and accelerators. They provide end-end business services and a captive end market of consumer households. With fewer worries of building a supply chain or raising tons of upfront capital, entrepreneurs can focus on their core function of building great products. It’s no surprise that innovation is accelerating at a faster rate today than ever before. And the structural change brought upon by technology has compromised the impregnable Marketing Moat of CPG: The high costs of advertising and marketing aren’t quite the same barriers to entry they were in the past. Facebook, YouTube, and the like are global platforms, where the cost to advertise is almost a fraction of its traditional competitors. Good storytellers have a cost-efficient avenue to introduce products to the entire world, almost over-night. For decades, even if consumers wanted to change, they had limited choices. Consumers had to buy what CPG was selling. Therefore, preferences couldn’t change. Now, these barriers to entry have been removed, and new products are entering the arena at a rapid pace and affording our ‘tastes and preferences’ the opportunity to change at a much faster pace. The CPG giants haven’t adapted to this pace of change. They have been competitor-focused instead of consumer-focused. Kraft-Heinz, supported by the lean management philosophy of 3G and Buffett’s pocketbook, was on the prowl for other CPG companies. To protect from this threat, most companies in this sector embarked on aggressive cost-cutting programs. Instead of ramping up R&D spent, they have been cutting back. And industries that do not innovate and have low barriers to entry – even with differentiated products – do not have the right to earn an above-average return on invested capital. It’s as simple as that. They are far from boring. Consumer Staples have produced the best returns vs. other sectors over the past 50 years, with the second-lowest volatility (Utilities have the lowest volatility). Talk about having your cake and eating it too! Those prodigious returns are now history. Expect future returns on invested capital for this industry to be much lower than the past. This doesn’t bode well for future stock prices. The Energizer bunny that symbolized CPG multi-decade long run is finally running on low. --- This material does not constitute an offer or solicitation to purchase an interest in Latticework Partners, LP (the "Fund"). Such an offer will only be made by means of a confidential offering memorandum and only in those jurisdictions where permitted by law. An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. This material contains certain forward-looking statements and projections regarding the future performance and asset allocation of the Fund. These projections are included for illustrative purposes only, are inherently speculative as they relate to future events, and may not be realized as described. These forward-looking statements will not be updated in future.

1 Comment

8/29/2019 03:30:13 am

It is really important that you keep track of the food that are in your storage. If you ask me, there are a lot of wasteful households who do not keep track of where their supplies are at. I know, I might sound like a real pain, but trust me, this is what you need to do. Always keep track of what is in your storage. You can save a lot of money by simply keeping track of what you got.

Reply

Leave a Reply. |

Amol DesaiI am an investor and these are my personal thoughts on investing, behavioral finance, markets, and sports viewed through the prism of a Latticework |

Proudly powered by Weebly