|

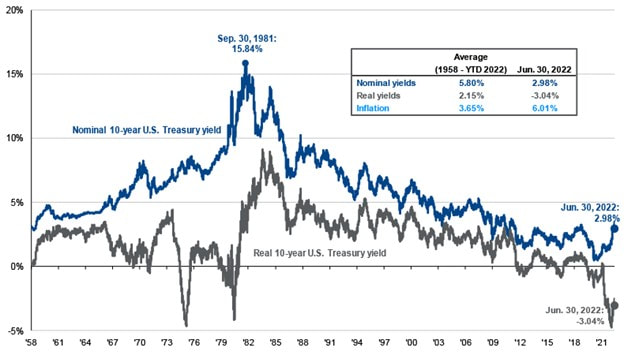

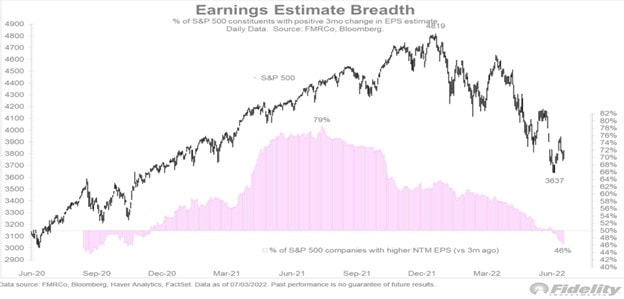

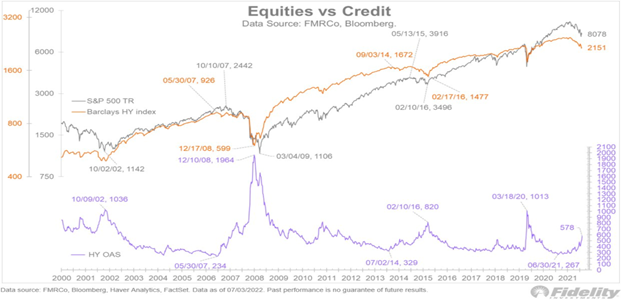

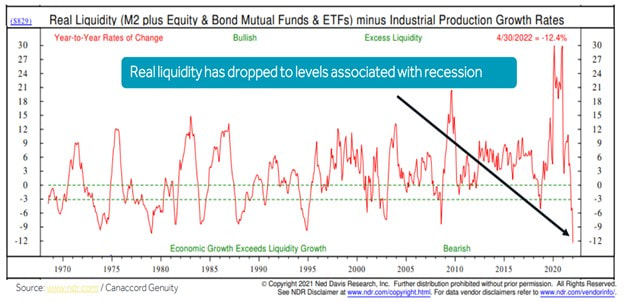

Markets are complicated. Simplify and keep it REAL. REAL is a practical risk-on/risk-off framework to monitor market conditions. REAL is an acronym to monitor changes in Rates, Earnings breadth, Availability of credit, and Liquidity waves. Consider this a dimmer, not an on-off switch. When every component is worsening, be fearful. When every component is improving, be greedy. Rates: A practical risk-free rate is the 10-year U.S. treasury. As the 10-year goes up, future cash flows are worth less and vice versa. In 2022, the 10-year has doubled, at the fastest pace in history. Higher rates make big-ticket purchases less affordable. Rapidly rising rates are bad for markets. Chart 1 - Nominal and Real U.S. 10 Year Treasury Yield Source - JP Morgan Asset Management Earnings Breadth: When earnings for a wide range and breadth of companies in disparate industries are rising, economic and market expansion has momentum. The market advance is durable. Today, the earnings expansion is transitioning to earnings contraction. The number of companies and industries where earnings are declining is rising. Earnings breadth is deteriorating, which is bad for markets. Chart 2 - S&P Earnings Breadth Source - Jurien Timmer, Fidelity Availability of Credit: Credit is the grease that keeps the economic wheel turning. As economic uncertainty rises, banks reduce the amount they lend and charge higher rates. Individuals and businesses with lower credit scores find it harder to get loans. Similarly, investors demand an above-average compensation to own risky investments. This is reflected in rising credit spreads (see the purple line on chart 3). The higher spread eventually cascades all the way to every corner of the market, regardless of the underlying quality, and compresses the valuation of all assets. When credit becomes scarce, the grease dries, the economic wheel stops turning, and markets fall. Chart 3 - S&P 500 and High Yield Credit Spreads Source: Jurien Timmer, Fidelity Liquidity waves: Liquidity moves markets. When the Fed provides liquidity via Quantitative Easing, investors rush in and take risk. Equity market goes up. When the Fed stops, the opposite happens. In 2022, liquidity has contracted at the fastest rate in history. Rapidly declining liquidity leads to declining markets. Chart 4 - Liquidity Source: Ned David Research/ Canaccord Genuity

When I wrote ‘Draining the Punch Bowl’ (LINK) in January, it was in anticipation that multiple components of the REAL framework would deteriorate. They have. As a result, the S&P 500 declined by 20% in the first quarter of 2022. For markets to stop declining and stage a durable turnaround, Rates, Earnings breadth, Availability of credit, and Liquidity need to reverse. Don’t guess. Keep it REAL.

1 Comment

anks for sharing the article, and more importantly, your personal experience mindfully using our emotions as data about our inner state and knowing when it’s better to de-escalate by taking a time out are great tools. Appreciate you reading and sharing your story since I can certainly relate and I think others can to

Reply

Leave a Reply. |

Amol DesaiI am an investor and these are my personal thoughts on investing, behavioral finance, markets, and sports viewed through the prism of a Latticework |

Proudly powered by Weebly