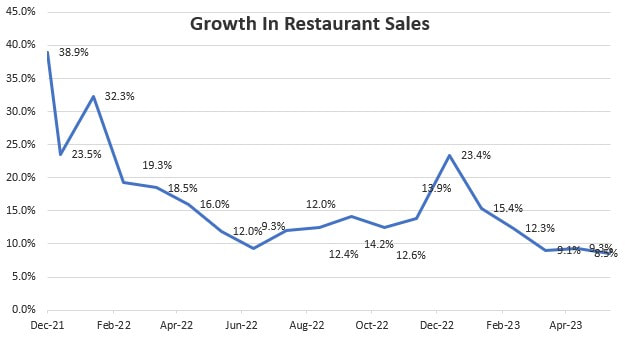

What were the odds the Federal Reserve could raise rates dramatically, reduce inflation, minimize job losses, AND preserve overall demand? Low to none. However, the data suggests that the odds of success are rising dramatically. Demand is resilient, wages are falling, inflation is falling faster, and jobs are STILL plentiful. We are in Goldilocks. Goldilocks is an economic environment where both demand and supply are in balance. Not too hot, not too cold. Goldilocks is important because the Fed now believes it has regained control of inflation, and it can slowly pivot to re-focusing on preserving demand. Is Goldilocks temporary? The economic pessimist would point to 1) interest rate increases have a lagged effect and 2) the negative impact on the economy will be evident in the 2nd half of 2023. The leading indicators are pointing to a slowing economy. Large rate increases make the slowdown unavoidable. However, as inflation slows, the odds of a less severe slowdown are rising dramatically. Chart 1: Growth In Restaurant Sales Growth is resilient, so far Most macroeconomists look at GDP projections to understand growth. While GDP is growing, and growing faster than most estimates, investors should look at more meaningful measures. One such measure is overall eating out sales. When consumers are unsure about the future, one of the first places where we cut back is eating out. Eating at home is cheaper. As chart 1 indicates, restaurant sales growth over the past six months is unchanged. When the outlook becomes uncertain, restaurant sales will be the first to signal change. Chart 2: Atlanta Fed Sticky CPI ex rent at 2% (3 month annualized) Inflation is falling Inflation was clearly a problem. The global economy encountered a once-in-lifetime demand and supply shock – at the same time. However, that is in the past. The money that was pumped into the system has made its way in, and out. Demand is back to normal. The supply shock from a total shutdown and reopening is also behind. Therefore, inflation is falling and falling faster than most are willing to believe. The leading indicator for inflation is the Atlanta Fed sticky CPI excluding rent. The latest reading shows CPI down from 8% to 2%. The Fed believes 2% is the ideal level for inflation. More details on inflation are here. Chart 3: Unemployment Claims (blue) and Job Openings (white) Despite rising layoffs, employment is steady Corporations right-size their cost structure when they expect future profits to be lower. One way to right size is to reduce the number of employees. Not a day goes by without reading layoff announcements by major corporations. Despite rising layoffs, unemployment claims (blue line) - a leading indicator that signals a rise in unemployment - are at record lows. Therefore, laid-off employees are finding new jobs rather easily. New job openings (white line) are close to all-time highs. While most leading economic indicators are at recessionary levels, employment claims are the key measure. A low level of claims indicates employment is not an issue, so far. The economic silver lining in rising layoffs – if there is such a thing – is layoffs are reducing the pressure on wages increases. This is the Fed's goal! Chart 4: Wages (yellow) are rising faster than inflation (red) Net savings deficit to surplus

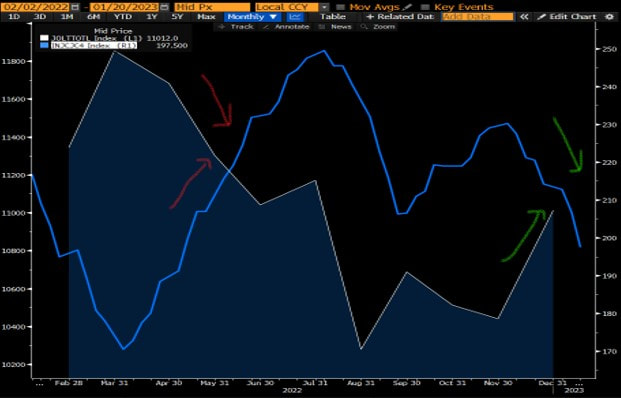

Consumer spending drives the economy. For this engine to keep moving, jobs must be plentiful, and incomes must grow more than expenses. In 1Q22, inflation was rising faster than wages (red arrow), which was a headwind for savings and spending. However, that has reversed. Wages are now growing at a faster rate than expenses (green arrow) which creates consumer surplus. The Fed's goal is to reduce inflation by cooling wage growth, without causing large job losses. As unlikely as this may have been last year, demand is resilient, wages are falling, unemployment claims are falling, and inflation is falling faster. This is GOLDILOCKS. The probability is rising that the Fed is less foe and more friend in 2H23. Markets are rallying in response to goldilocks. The sustainability of goldilocks is a question that only time can answer. Until then, enjoy it. -- This material does not constitute an offer or solicitation to purchase an interest in Latticework Partners, LP (the "Fund"). Such an offer will only be made by means of a confidential offering memorandum and only in those jurisdictions where permitted by law. An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. This material contains certain forward-looking statements and projections regarding the future performance and asset allocation of the Fund. These projections are included for illustrative purposes only, are inherently speculative as they relate to future events, and may not be realized as described. These forward-looking statements will not be updated in future.

2 Comments

3/23/2023 02:32:18 am

We’ll list all the reasons why your tattoo might be bugging you and how you can get it to chill out.

Reply

3/23/2023 02:32:41 am

Tattoos are at their itchiest when they’re fresh, but actually, they can develop an itch at any point (even when they’re years old). But don’t worry—that itchiness doesn’t have to last forever!

Reply

Leave a Reply. |

Amol DesaiI am an investor and these are my personal thoughts on investing, behavioral finance, markets, and sports viewed through the prism of a Latticework |

Proudly powered by Weebly