|

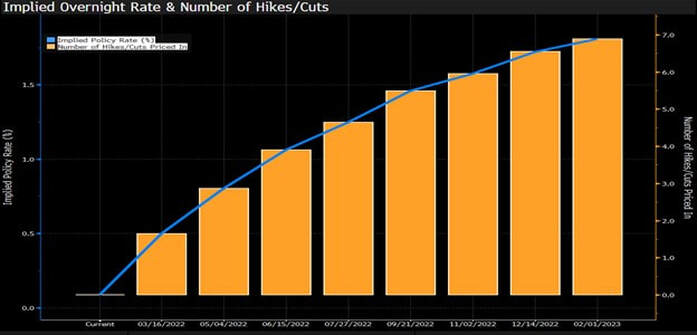

Late last year, there were multiple data points screaming that inflation was rising at an alarming rate, labor markets were very strong, and interest rates were in record negative territory. Therefore, the Fed was extremely behind in normalizing policy. One need not be a ‘Macro investor’ to come to this simple conclusion. The payoff to protect portfolios was asymmetric and in favor of one who has the courage to go against this trend. When I wrote this note (LINK) most of the replies that I received were that inflation was ‘transitory’. After two consecutive prints of CPI > 7%, that narrative has flipped on its head.  Source - Bloomberg However, over the past month, most investors and economists are now racing to beat each other in predicting record rate hikes. As of today February 17th, markets are expecting a half percentage point rate hike in March and 7 hikes over the course of the next twelve months. Most now have a view - whether the Fed will hike slower than - or faster than the market expectation. As investors, Game Selection is a critical choice. What area can one spend their precious resource – time – and expect a differentiated insight from the rest of the market? For most, individual securities may be a good game. For others it may be macro forecasting. However, when it comes to the Fed, the base rate for successful prediction is abysmal for multiple reasons:

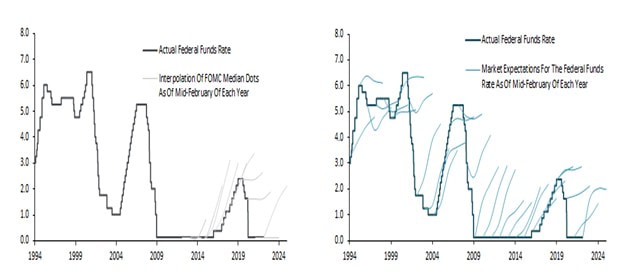

Source – Roberto Perli, Piper Sandler

As correctly pointed by out by economist Roberto Perli in the chart on the right, most historical predictions on future Fed policy have been wildly incorrect. The lighter lines above represent market expectations for Fed Funds rates as of Mid-February of that year. As you can tell, the forecasts are spectacularly wrong. The lighter lines on the left chart are projections of the Fed itself about future rate hikes, and they are generally wrong also. Here is the punch line, select a game only when the odds of winning are high. When it comes to future rate increases, we are all speculating. So is the Fed.

2 Comments

8/28/2022 10:35:34 am

anks for sharing the article, and more importantly, your personal experience mindfully using our emotions as data about our inner state and knowing when it’s better to de-escalate by taking a time out are great tools. Appreciate you reading and sharing your story since I can certainly relate and I think others can to

Reply

8/28/2022 10:44:43 am

or sharing the article, and more importantly, your personal experience mindfully using our emotions as data about our inner state and knowing when it’s better to de-escalate by taking a time out are great tools. Appreciate you reading and sharing your story since I can certainly relate and I think others can to

Reply

Leave a Reply. |

Amol DesaiI am an investor and these are my personal thoughts on investing, behavioral finance, markets, and sports viewed through the prism of a Latticework |