|

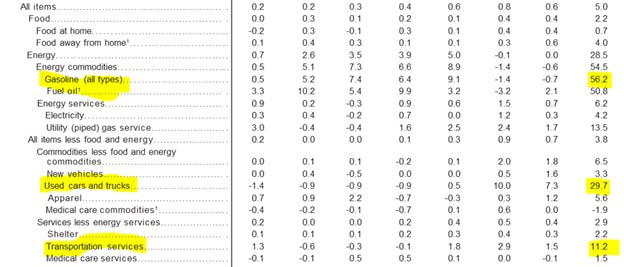

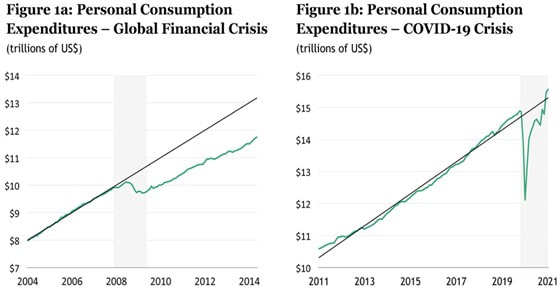

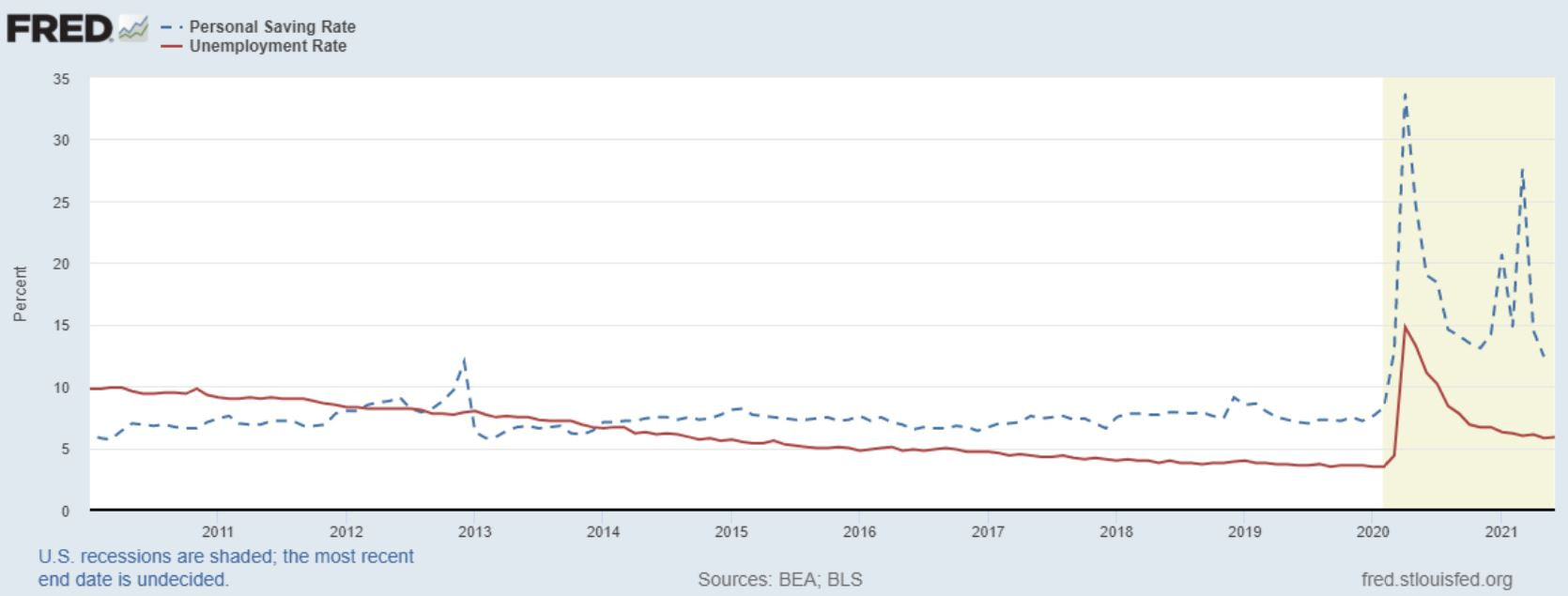

This week, a Federal Anti-Trust judge dismissed the Federal Trade Commissions (FTC) case against Facebook. Let me start by saying that I am not a legal expert. However, we can always learn from the past. Historically, the successful anti-trust cases had one thing in common – they controlled supply. In an analog world, that mattered. Consumers had no other way of getting goods or services. However, Facebook, or other Tech giants for that matter, control demand. It is much harder to prove bad intentions when consumers keep coming back. This likely is just the beginning - not the end - of the FTCs pressure on tech giants. The outcome is …. complicated. Here is the link to the entire post from September 2019. [LINK] Is Inflation Here To Stay? For the past two decades, most companies have been rewarded for efficiency. Lean and mean was the way to operate. The global closing and reopening of businesses, government stimulus, and the lack of labor has exposed supply chains. Bottlenecks everywhere have exploded. The knock-on effects are also unpredictable. A chip shortage has affected new car production – exactly at a time - when consumers are moving to the suburbs in droves. In the absence of new cars, used cars are a hot commodity. As of May’s consumer price (CPI) report, used car and truck prices are 29% higher. Prices of oil were negative a year ago, and now they are in the 70’s. The business models of Uber and Lyft were predicated of rational economic principles. If demand rises, then raise prices. Higher prices (surge pricing) will incentivize drivers to offer their services, which will bring the market into equilibrium. The algorithm could not plan for Covid + unemployment benefit where drivers are incentivized to be a ‘couch potato’. In short, things are upside down. However, these disruptions are temporary. Over a year, most of these abnormalities will ‘normalize’. Does this mean we will revert to the old world of low growth and low inflation? Our economy is a complex machine. Post the global financial crisis, consumers had record low savings. The two major savings buckets: 1) home, and 2) 401k, were severely impaired. Therefore, consumer spending (green line) for several years post GFC was anemic and below trend (figure 1a from Blackstone). Post-Covid, we have an entirely new ball game. Consumption has raced above the trendline (figure 1b from Blackstone). Home prices and 401k’s are surging. It is logical to assume that spending will slow as stimulus runs out. However, as we exit 2021, the unemployment rate will be half of 2010’s level and savings rate will be more than double (see below). The simple conclusion here is that the pent-up demand to ‘live life’ after Covid is real and consumers have the resources to follow-thru. Roaring 20’s anyone? Is hyper-inflation in the forecast? The key condition for high inflation - is growth - that creates a sustained shortage of labor. While higher consumer spending is good for employment, there are lots of offsetting factors. Given the rate at which software and robotics are entering the adoption curve, any sustained tightness in labor is hard to envision. Investments in automation will accelerate and provide a key buffer. For once, the Federal Reserve may be correct to ignore the current high inflation readings, as temporary. I am hoping they get it right. As the great Yogi said, it’s tough to make predictions, especially about the future. -- This material does not constitute an offer or solicitation to purchase an interest in Latticework Partners, LP (the "Fund"). Such an offer will only be made by means of a confidential offering memorandum and only in those jurisdictions where permitted by law. An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. This material contains certain forward-looking statements and projections regarding the future performance and asset allocation of the Fund. These projections are included for illustrative purposes only, are inherently speculative as they relate to future events, and may not be realized as described. These forward-looking statements will not be updated in future.

1 Comment

8/28/2022 04:48:12 am

anks for sharing the article, and more importantly, your personal experience mindfully using our emotions as data about our inner state and knowing when it’s better to de-escalate by taking a time out are great tools. Appreciate you reading and sharing your story since I can certainly relate and I think others can to

Reply

Leave a Reply. |

Amol DesaiI am an investor and these are my personal thoughts on investing, behavioral finance, markets, and sports viewed through the prism of a Latticework |

Proudly powered by Weebly